Feie Calculator Things To Know Before You Get This

Wiki Article

Feie Calculator - The Facts

Table of ContentsFeie Calculator Can Be Fun For AnyoneFeie Calculator - The FactsGetting The Feie Calculator To WorkSome Known Details About Feie Calculator Feie Calculator - Truths

He marketed his United state home to develop his intent to live abroad permanently and used for a Mexican residency visa with his partner to assist meet the Bona Fide Residency Test. Neil directs out that buying residential or commercial property abroad can be challenging without initial experiencing the area."We'll most definitely be outdoors of that. Even if we come back to the United States for physician's visits or business phone calls, I question we'll spend more than 30 days in the United States in any type of given 12-month duration." Neil emphasizes the value of rigorous monitoring of U.S. visits (Taxes for American Expats). "It's something that individuals require to be truly diligent regarding," he states, and advises expats to be mindful of common mistakes, such as overstaying in the U.S.

The Main Principles Of Feie Calculator

tax commitments. "The factor why united state taxes on globally revenue is such a huge deal is because many individuals forget they're still subject to united state tax also after transferring." The U.S. is just one of minority nations that tax obligations its citizens no matter of where they live, implying that even if a deportee has no revenue from united stateincome tax return. "The Foreign Tax Credit history enables people functioning in high-tax nations like the UK to counter their U.S. tax obligation responsibility by the quantity they have actually already paid in tax obligations abroad," says Lewis. This makes certain that expats are not taxed two times on the very same income. Those in reduced- or no-tax countries, such as the UAE or Singapore, face additional obstacles.

Facts About Feie Calculator Uncovered

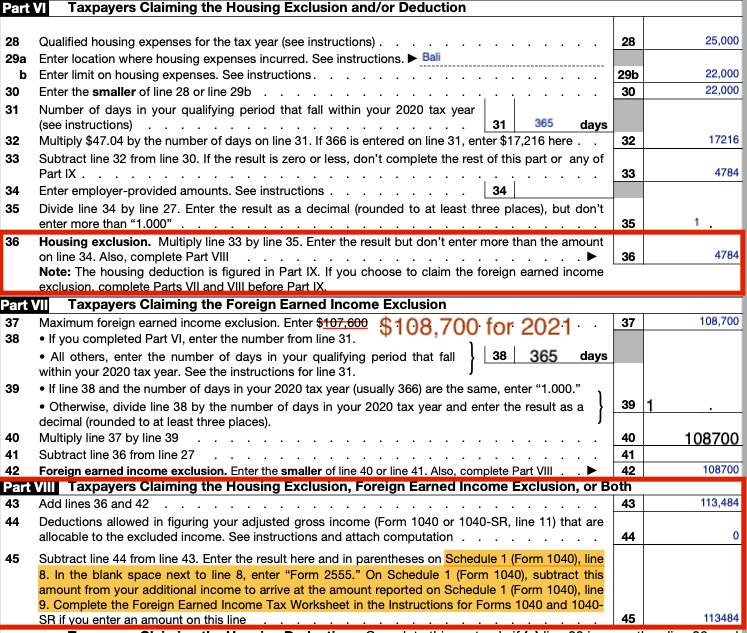

Below are some of one of the most regularly asked questions regarding the FEIE and various other exclusions The International Earned Revenue Exclusion (FEIE) enables U.S. taxpayers to leave out as much as $130,000 of foreign-earned earnings from government earnings tax obligation, reducing their sites U.S. tax liability. To get FEIE, you need to meet either the Physical Existence Test (330 days abroad) or the Bona Fide Home Test (show your main house in an international nation for a whole tax year).

The Physical Existence Test requires you to be outside the united state for 330 days within a 12-month period. The Physical Presence Examination additionally requires united state taxpayers to have both a foreign income and a foreign tax home. A tax home is defined as your prime area for business or work, no matter your household's home.

A Biased View of Feie Calculator

An earnings tax obligation treaty in between the united state and another nation can help stop dual taxes. While the Foreign Earned Income Exemption reduces taxed revenue, a treaty may give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Record) is a required declare united state citizens with over $10,000 in international monetary accounts.Eligibility for FEIE depends on meeting details residency or physical visibility examinations. He has over thirty years of experience and now specializes in CFO solutions, equity settlement, copyright taxes, cannabis taxation and separation associated tax/financial planning issues. He is a deportee based in Mexico.

The international earned income exemptions, often referred to as the Sec. 911 exemptions, exclude tax on incomes made from working abroad. The exemptions make up 2 parts - an income exemption and a real estate exclusion. The complying with Frequently asked questions go over the benefit of the exclusions consisting of when both partners are deportees in a general way.

Feie Calculator for Beginners

The tax obligation benefit excludes the income from tax at bottom tax prices. Previously, the exclusions "came off the top" minimizing revenue topic to tax at the top tax obligation prices.These exclusions do not excuse the salaries from US taxation however simply supply a tax reduction. Note that a bachelor working abroad for all of 2025 that made regarding $145,000 without any other earnings will have gross income lowered to no - properly the same response as being "free of tax." The exemptions are calculated on an everyday basis.

Report this wiki page